Eitc calculator 2021

In 2015 California established the first-ever CalEITC to extend a supplemental cash-back credit to the poorest working families in the state. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

Claim Your 2018 Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

For tax year 2021 forward there are new qualifying criteria for taxpayers with the filing status marriedregistered domestic partners RDP who file separately.

. For the EITC an SSN is a valid SSN unless Not Valid for Employment is printed on the social security card and the number was issued solely to allow the recipient of the SSN to apply for or receive a federally funded benefit. Use any of these 10 easy to use Tax Preparation Calculator Tools. Required Field How much did you earn from your California jobs or self-employment in 2021.

Here is a look at what the brackets and tax rates are for 2021 filing 2022. Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020. Earned Income Tax Credit Calculator.

On June 30 2021 you pay advance rent of 12000 for the last 6 months of 2021 and the first 6 months of 2022. You may receive this payment if you received the Oregon Earned Income Tax Credit EITC on your 2020 tax filing. You can deduct only 6000 for 2021 for the right to use property in 2021.

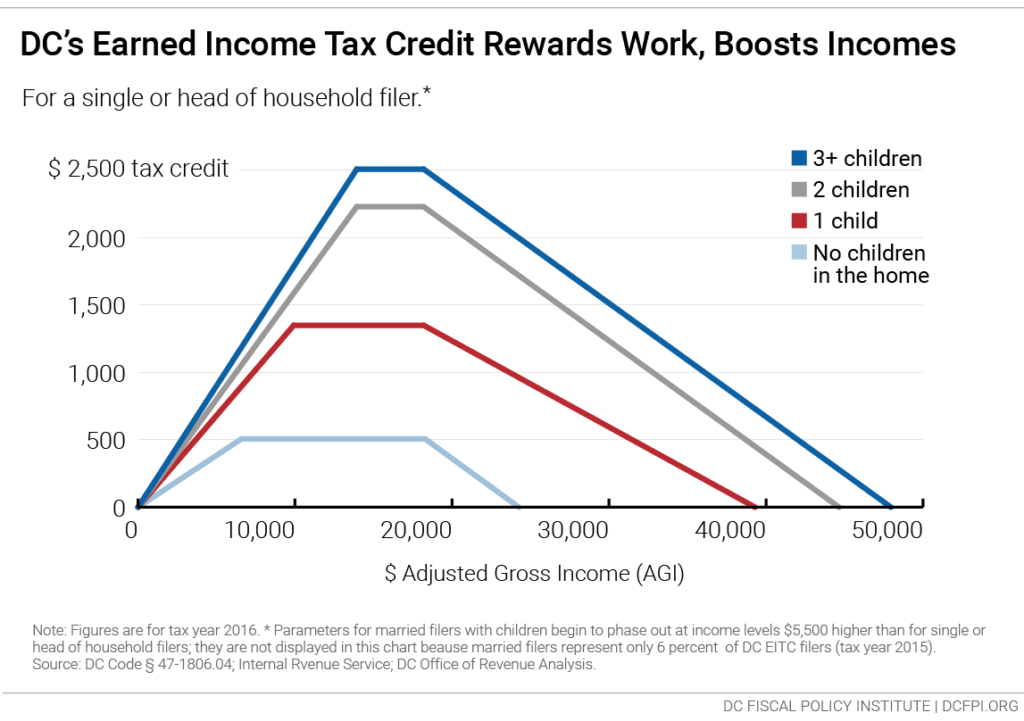

The levels vary based on filing status and number of children. You are an accrual method calendar year taxpayer and you lease a building at a monthly rental rate of 1000 beginning July 1 2021. How to claim it on your 2021 Return details and.

Whole dollars no commas. The standard rate for medical and moving purposes is based on the variable costs as determined by the same study. Citizen or resident and other income requirements.

EITC is widely recognized as one of the nations most powerful resources for lifting low-income people out of poverty. Use the EITC calculator for an estimate. Available in 6 languages.

Find out how much you could get back by using the Franchise Tax Boards EITC. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file. If youre eligible for the EITC.

How Income Taxes Are Calculated. You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. Find out how much you could get back Required Field.

NJEITC if youre eligible for the federal EITC which is a refundable tax. Doubles the Standard Deduction. Income Limits and Range of EITC - Get income limits for claiming the EITC.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you are between the ages of 25 and 65 are single and have no dependents you must make less than 21430 to qualify for the federal EITC. You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status.

Section 179 deduction dollar limits. Changes the Seven Tax Rates. To claim the EITCEIC on your 2021 IL-1040.

Estimate Your 2022 Tax Refund For 2021 Returns. Before beginning taxpayers should have a copy of their most recent pay stub and tax return. The average amount of EITC received nationwide was 2411.

Estimated IRS Refund Tax Schedule for 2021 Tax Returns In prior years the IRS issued its refund tax schedule to provide a timeline of when you can expect to receive your tax refund. Use this calculator to find out. Find out how much you could get back.

You meet the basic rules valid SSN qualifying filing status US. If you are married filing jointly are between the ages of 25 and 65 and have no dependents you must make. The Earned Income Tax Credit - EITC or EIC - is a refundable tax credit aimed at helping families with low-to-moderate earned income.

Colorado Income Tax Calculator 2021. The EITC Assistant Use this calculator to find out if your client is eligible for the EITC. See more information on the advance CTC payments.

New Jersey Income Tax Calculator 2021. The payments amounted to nearly 142 million paid from federal pandemic aid approved by Congress in 2021. Nationwide as of December 2021 approximately 25 million taxpayers received over 60 billion in EITC.

The EIC reduces the amount of taxes owed and may also give a refund. Your household income location filing status and number of personal exemptions. Types of Earned Income Wages salary or tips where federal income taxes are withheld on Form W-2 box 1.

The maximum federal EITC amount you can claim on your 2021 tax return is 6728. Who is eligible to receive the one-time assistance payments. During 2019 25 million taxpayers received about 63 billing in Earned Income Credit.

The new rates are 10 12 22 24 32 35 and 37They will phase out in eight years. Check if you qualify for CalEITC. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Results from the calculator will include a recommendation of whether or not users should consider submitting a new Form W-4 Employees Withholding Allowance Certificate to their employers. Examples include the earned income tax credit EITC child tax credit and the American Opportunity Tax Credit. The Earned Income Tax Credit EITCEIC is a benefit for working people with low to moderate income that reduces the amount of tax owed and may result in a refund.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Earned Income Tax Credit EITC helps low to moderate-income workers and families get a tax break.

Tax Reform Changes for Tax Years 2018. If you have not yet filed a 2020 Tax Return or generally dont file taxes at all you can file your 2020 Return if you need to claim Stimulus 1 andor 2You can no longer receive the advance payments through 2021 - claim your full credit amount by e-filing a 2021 Return in 2022. Your earned income and Adjusted Gross Income AGI are within certain limits in 2021 your earned income must be less than 57414 if youre married filing jointly with three or more children.

The standard deduction amount is increased from 6350 to 12000 for Single and Married Filing Separately filers 12700 to 24000 for Married Filing Jointly and Widow filers. 2020 September 18 Illinois income tax calculator. The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes.

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. An example of a federally funded. 2021 Tax Brackets Due April 15 2022.

The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile. Bentle K Berlin J and Yoder C. Here are step-by-step instructions for using the calculator.

More Than Just A Refund Eitc Helps Lift People From Poverty The Center For Community Solutions

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Earned Income Credit Eic Table 2020 2021 Free Tax Filing Tax Time Tax Refund

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Earned Income Tax Credit Eitc What Is It Who Qualifies Nerdwallet

Refundable Tax Credits

Dc S Earned Income Tax Credit

Earned Income Credit Eic

Earned Income Tax Credit Eic Overview 8220 Tax Preparation Law 2021 2022 Youtube

Earned Income Tax Credit

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Earned Income Tax Credit La Cooperativa Campesina De California

Earned Income Tax Credit Eitc Tax Preparation 2020 Youtube

Summary Of Eitc Letters Notices H R Block

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District